Not All Mortgages Are the Same

- The mortgage-backed securities market has grown into a diverse market, offering investors a multitude of differentiated products to meet specific needs.

- Agency and non-agency mortgage-backed securities have historically provided attractive yields and high credit quality, as well as a wide variety of available securities.

- The market is complex and ever-evolving, but there are opportunities for managers to leverage different types of mortgage-backed securities to mitigate risk.

- At Diamond Hill, we believe security selection is key and apply a bottom-up approach to identify, and capitalize on, market inefficiencies.

To understand the mortgage market today, it’s useful to look back on its history and how it has grown into a $10+ trillion market.1 The Federal Housing Authority (FHA) was created in 1934 during the Great Depression as part of the New Deal to assist in the construction, acquisition, and rehabilitation of residential properties. The FHA created and insured the fixed-rate mortgage to replace balloon payment mortgages and to help standardize the overall market. Four years after the FHA was created, the Federal National Mortgage Association (Fannie Mae) was created to provide a liquid secondary market for mortgages so that mortgage originators could sell newly minted mortgages to Fannie Mae and use the proceeds to underwrite additional mortgages, namely FHA-insured mortgages. In 1968, Fannie Mae was split, creating the current iteration of Fannie Mae, tasked with purchasing private mortgages, and the Government National Mortgage Association (Ginnie Mae), focused on supporting FHA-insured mortgages, Veterans Administration, and Farmers Home Administration-insured mortgages. The Federal Home Loan Mortgage Corporation (Freddie Mac) was created in 1980 to expand the secondary market for mortgages and create competition for Fannie Mae.

Agency and Non-Agency Mortgage-Backed Securities

Agency Mortgage-Backed Securities

In 1971, Freddie Mac issued its first mortgage pass-through security, which at the time was called a participation certificate. In 1981, Fannie Mae issued its first mortgage pass-through, or MBS, and in 1983 Freddie Mac issued the first collateralized mortgage obligation, or CMO. Agency MBS pass-through mortgages deliver a pro-rata share of the interest and principal payments made monthly by homeowners to the investors that have purchased the security, while CMOs use tranches to distribute the risk and cash flows associated with a mortgage pool.

Both Freddie Mac and Fannie Mae are considered Government Sponsored Enterprises (GSEs), but do not carry an explicit guarantee from the U.S. government. On the other hand, Ginnie Mae mortgage-backed securities (MBS) are backed by the “full faith and credit” guarantee of the U.S. government. While there is not an explicit guarantee on the mortgage-backed securities issued by Fannie Mae and Freddie Mac, consensus has been that these securities maintain an implied guarantee that would prevent a disastrous default.

Non-Agency Mortgage-Backed Securities

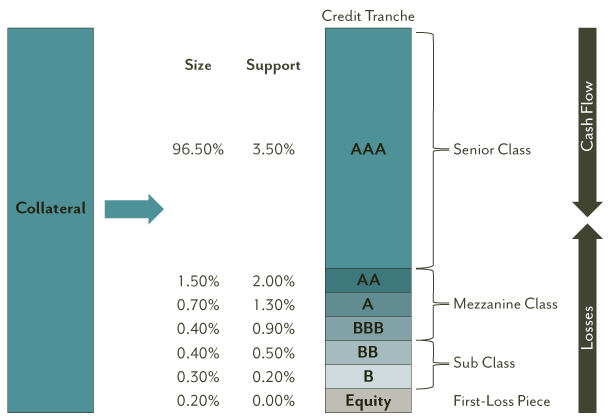

The non-agency mortgage backed-securities market began in the late 1970s as an alternative to the government-backed MBS market. While the initial issuance by Salomon Brothers was considered a failure at the time, it laid the ground work for what would eventually become the non-agency MBS market. Limited by various state regulations and Depression-era securities laws, Congress passed the Secondary Mortgage Market Enhancement Act of 1984, which called on National Recognized Statistical Rating Organizations to provide credit opinions on each mortgage pool and charged the SEC with regulating the trading of these securities. This significant change opened up the mortgage market to federally-chartered financial institutions, including credit unions, but these new entities would never have the same level of guarantee, implicit or explicit, enjoyed by the GSEs and Ginnie Mae. To create bonds that would be considered of equal quality to the GSEs and Ginnie Mae, at least from a rating agency standpoint, non-agency MBS issuers opted to separate pooled mortgages into tranches. Figure 1 below illustrates how the implementation of tranches enabled issuers of non-agency mortgage-backed securities to appeal to a variety of investors by delivering different options based on investors’ risk appetite. For example, the senior class tranche is positioned such that the underlying tranches support and absorb any losses before they reach the senior class. Also, cash flows for the overall pool flow into the senior tranche first, paying it down with interest and principal payments, while the underlying tranches only receive interest payments once the tranche directly above is paid off in full.

FIGURE 1: TRANCHE STRUCTURE

Types of Mortgage-Backed Securities

To Be Announced (TBAs)

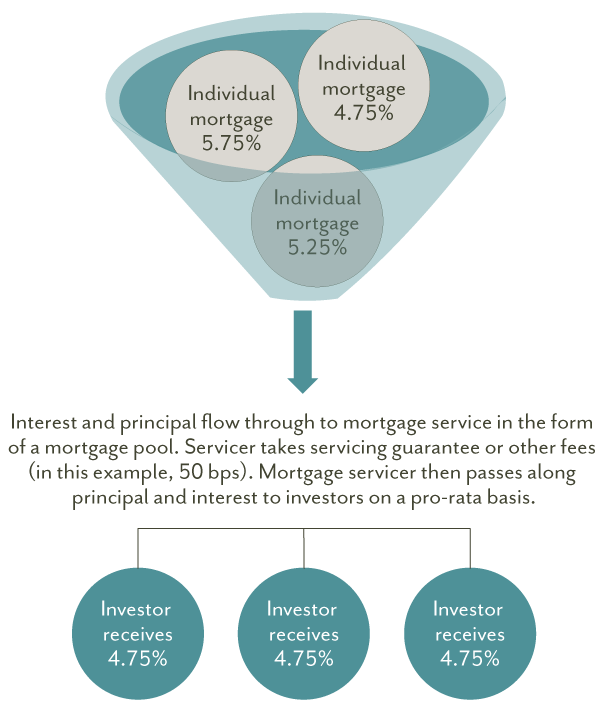

In a TBA mortgage transaction, the seller of the mortgage-backed security agrees on a sale price without specifying which individual mortgages will be delivered on the date of settlement. Basic characteristics are agreed upon, such as coupon rate and the face value of the bonds to be delivered, but little else. The process of combining a variety of different pools into a standard format ensures that the TBA market is the most liquid mortgage market. Since these are the most liquid and readily tradable mortgage securities, they serve as the basis for pricing a variety of mortgage-backed securities. The cash flows in both TBA mortgages and specified pools utilize the pass-through process, where investors receive a pro-rata share of both principal and interest for the mortgages included in the pool (see Figure 2 below). This process can expose investors to prepayment or extension risk as rates move lower or higher, respectively.

FIGURE 2: PASS-THROUGH STRUCTURE

Specified Pools

Specified pools, unlike TBAs, are securities associated with specific mortgage pools rather than a generic portion of the market. These pools are not as liquid as the TBA market due to their heterogeneity compared to TBAs. However, they do allow for more granular detail on the underlying mortgages and the opportunity to focus on specific attributes of the mortgage loan, such as seasoned mortgages, specific geography, or loans with maximum balances.

Collateralized Mortgage Obligations (CMOs)

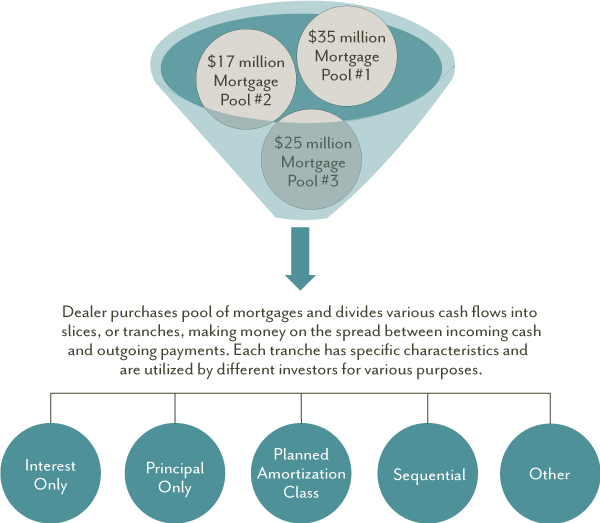

Collateralized mortgage obligations (CMOs) were first introduced to the market in 1983, fueled by investors looking to split out various cash flows from specified pools. Investment banks dissected mortgage pools into various cash flows, each targeted to different risk/return profiles. CMOs were orginally established as a sequential alternative to the pass-through market. As the cash flows in a mortgage pool were broken into tranches, each tranche had an assumed weighted average life and tranches were not paid until the bond ahead of it was paid off. As the market evolved, so too did the CMO market, as investment bankers created more and more types of CMOs to address specific client needs. The combination of mortgage pools and subsequent breakdown into CMO tranches is illustrated in Figure 3.

FIGURE 3: CMO STRUCTURE

Planned Amortization Class (PAC) Tranches

PAC bonds were first issued in 1986 and represented some of the most innovative work in the CMO market at the time. Unlike a pass-through mortgage, a PAC bond is designed to have a favorable weighted average life profile if prepayments and extensions remain within a preordained range. PAC bonds have a specified principal payment schedule and are given priority for principal paydowns over other bonds in the pool, aptly named companion bonds. In a falling interest rate environment, borrowers that refinance to take advantage of the lower rates flood the mortgage deal with additional cash. Companion bonds to a PAC bond will absorb some of these additional cash flows to maintain the stability of cash flows of the PAC bond. Conversely, if interest rates are climbing and less money is coming into the pool due to a reduction in refinancing, companion tranches will forgo some of their cash flows to maintain the stability of the PAC bond. Because of this symbiotic relationship between PAC bonds and companion tranches, PAC bonds can prove to be more stable in a volatile interest rate environment and, as expected, the companion bonds have more sensitivity to interest rate fluctuations and are therefore more volatile.

Sequential Tranches

Sequential tranches are established in a specific order, with a single tranche receiving all principal payments before all other tranches until it is paid in full. This structure creates a series of bonds with short, intermediate, and long maturities and are designed to meet specific investor needs. Despite the targeted maturities, there is still a degree of uncertainty based upon the optionality of the underlying mortgages as rates fluctuate.

Principal Only/Interest Only Tranches

As indicated by their names, principal only/interest only tranches of mortgage-backed securities focus solely on the principal and interest cash flows from a pool of mortgages. These securities have significantly different characteristics from other CMOs and mortgage securities due to the unique nature of these cash flows. For an interest-only security, the amount of interest received is directly tied to the principal balance outstanding, which in turn depends on the prepayment rate of the underlying mortgages. An increase in prepayments reduces the principal balance at a faster pace, leading to smaller interest payments in the future. A decrease in the speed of prepayments reduces the outstanding balance more slowly and results in larger interest payments. Due to the relationship between the principal and interest balances, the size of the payments from an interest-only bond will move in the same direction as rates. The value of an interest-only bond falls as rates decrease and increases as rates rise, thus generating negative duration (a bond’s sensitivity to interest rate movements). Principal-only securities’ sensitivity to interest rate movements is the exact opposite of interest-only bonds. When interest rates rise and prepayments slow, the value of the bond decreases and when rates fall, prepayments accelerate and the bond increases in value.

Other Types of CMOs

- Targeted Amortization Class (TAC) – These bonds are similar to PAC bonds but instead of protecting against both prepayment and extension risk, they provide protection from increasing prepayment speeds. Reverse TACs provide protection from a slowdown in speeds (extension).

- Floaters – A CMO structured so that its coupon resets on a regular basis (usually monthly) and follows a specific index plus a spread, oftentimes subject to a cap and/or floor.

- Inverse Floaters – Similar to the Floater, but with a coupon that moves in the opposite direction of a pre-determined index.

Convexity

While duration illustrates a bond’s sensitivity to interest rate movements and assumes a linear relationship between rates and price where rates increase and duration increases (and vice versa), convexity recognizes that the relationship between bond prices and interest rates is typically sloped, or convex, and measures the change in duration itself as rates move higher or lower. For small moves in interest rates, duration provides insight as to how a bond behaves from a pricing standpoint, though convexity is a better measure for large fluctuations in interest rates.

If a bond’s duration increases as yields increase and the opposite occurs as rates decrease, the bond has negative convexity. An example would be a plain vanilla pass-through mortgage: as rates increase, the duration of the bond extends as prepayments slow down. As rates decrease, the bond’s duration shortens as prepayments increase and borrowers refinance their mortgages.

Managing Mortgage-Backed Securities

Security selection is a key tenet of the investment process for the fixed income team at Diamond Hill, especially when considering mortgage-backed securities. A valuation approach often used for bonds with embedded options is to decompose the bond into its component parts. For mortgage-backed securities, we conduct a creation-value analysis. During this process, we use various tools including Bloomberg and Citigroup Yield Book as well as proprietary methodologies for valuation that provide a secondary verification of the primary analysis conducted with Yield Book. We believe securities selected after applying this analysis offer better relative returns compared to similarly structured securities.

Our focus on bottom-up, security selection differentiates Diamond Hill’s process from universal benchmarks and other managers in the fixed income universe. Our approach to investing in mortgage-backed securities has historically led to a significant overweight to CMOs in lieu of investing in the standard mortgage-backed securities held by the benchmark. A strict capacity discipline enhances our ability to continue exploiting inefficiencies in the mortgage market, while larger managers turn to the TBA market for their exposure to mortgages.

To learn more about Diamond Hill’s fixed income strategies, please call 855.255.8955.

1 As of October 31, 2019.

Originally published February 21, 2019.

The views expressed are those of Diamond Hill as of July 2020 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Investing involves risk including possible loss of principal.