Fixed Income Monthly Commentary — November 2020

As we head into the year’s final month, globally that’s often a time for pausing to give thanks. This year, that may range from small things like terrific shows to binge in shutdown (The Crown, The Mandalorian) to major things like the looming possibility of a vaccine and first responders battling on the front lines of a pandemic. Markets have also been giving thanks recently, evidenced by the massive rally in US stocks—rallying 63.6% since March 23 after falling -30.3% from year-end 2019 to the trough.

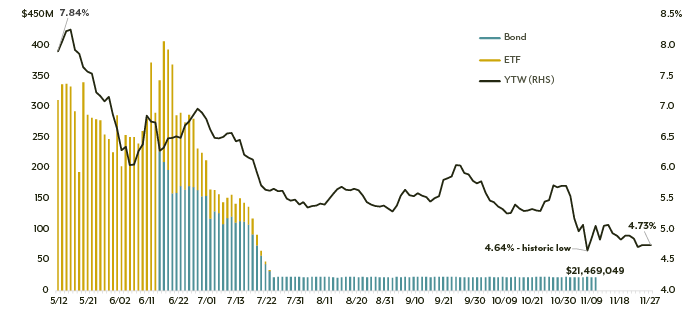

There are other aspects of the markets that investors can be thankful for in what has seemed like an otherwise unforgiving year. First, the Federal Reserve. Perhaps learning from the 2008-2009 financial crisis, the Fed knew that speed was key as the pandemic ramped up in mid- and late-March. After an initial 50 bps cut on March 3 as concerns began accelerating, the Fed followed with a Sunday night cut to zero ahead of the Monday market open. However, that wasn’t the only step taken. The return of quantitative easing of at least $700 billion in Treasury and mortgage backed-securities purchases began that Monday with no limit. Over the next week, the Fed launched a variety of programs aimed at keeping markets functioning:150 bps drop in the discount window, more flexibility in bank capital requirements, commercial paper funding facility, primary dealer credit facility, the money market fund liquidity facility (later extended to municipal debt) and the main street lending program, which targeted small and medium businesses. The biggest impact, however, came from two facilities that carried a significant amount of firepower but have never truly been utilized: the primary and secondary market corporate credit facilities (PMCCF and SMCCF). Both facilities were expanded on April 9 to include high yield ETFs and fallen angels that were investment grade prior to March 22. And, as we can see in Exhibit 1, the programs succeeded in bringing about order, some may say too much order, to the corporate debt market, with yields bumping up against historic lows during a time of economic uncertainty. Firms under pressure from lockdowns and travel restrictions (Carnival Cruise Lines, various airlines, Boeing) were able to secure financing to survive the drastic downturn.

Even with the Treasury department requesting the return of the funds allocated to their various programs shortly before Thanksgiving, the market seems unphased by the idea that these programs will be shut down.

EXHIBIT 1: SMCCF PURCHASES SINCE 1/1/20

Source: Bloomberg and The Federal Reserve.

Note: The Federal Reserve will not release November purchases until mid-December, but expectations are for an average near $20 million in purchases per day.

The second thing markets can be thankful for is the resilience of the consumer. Despite unprecedented hardships, consumers remain strong. As referenced in our May commentary, consumers used the decade since the financial crisis to fortify balance sheets, aided by historically low unemployment. At the end of 2019, consumers were the least levered they had been since 1980, with a total debt service ratio (DSR) of 9.7% and a consumer loan default rate of 2.3%, well below the historic average of 3.18%. The 9.7% DSR at the end of 2019 is the total required household debt payments to total disposable income, split between mortgage (4.1%) and consumer (5.6%) debt. Somewhat shockingly, the DSR actually dropped during Q1 and Q2 of 2020, with mortgage (3.72%) debt hitting an all-time low and consumer debt dropping below 5.0%. While some of this can be attributed to consumer strength coming into the pandemic, the majority of this outcome can be attributed to the CARES Act passed by Congress that provided economic relief. Smartly, consumers used the stimulus to pay current and long- term debt.

The consumer rebound can be seen in the performance of the consumer asset-backed securities (ABS) sector. Extreme volatility in March and April in the securitized space was unmatched even by the market turmoils of 2008 and 2001. An apt comparison would be to a run on the bank as investors looked to sell high quality, short duration assets into a market that had completely shut down. The impact on the consumer ABS space is illustrated in the performance of the sector in the Exhibit 2, which shows month-to-month performance of the space throughout 2020.

EXHIBIT 2: CONSUMER ABS PERFORMANCE

The subsequent recovery in the market is due, in part, to the transparency in the space. Every month, securitized products release a remittance report detailing collection and loss data, which provided insight into how consumers were handling their debt burden, and reporting showed that, for the most part,consumers held fast and continued to pay down debt. Through October, the year-to-date performance in the consumer ABS space has outpaced all major sectors in the market.

EXHIBIT 3: PERFORMANCE AS OF 10/31/20

Source: Bloomberg and Citi.

Finally, we should all be thankful for our friends and family, as we have all done our best to navigate this most unusual of years. And there’s no way that we would have made it through 2020 without the unending support and tireless efforts of front line workers, from nurses to doctors to support staff at hospitals. Given the recent increase in cases across the globe, we’ve still got some fight left, but with multiple vaccines waiting in the wings for deployment, we can enter into this holiday season with the hope that there’s a light at the end of the tunnel and 2021 will be a better year. Given what we’ve gone through in 2020, how can it not be?

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.