Fixed Income Monthly Commentary — April 2021

Markets have become obsessed with two important factors that will impact future portfolio returns:

- Inflation rising beyond transitory.

- Understanding the Federal Reserve’s definition of “substantial further progress.”

Because we are bottom-up investors at Diamond Hill, we typically don’t make calls on the direction of interest rates, inflation predictions or interpretations of Fed commentary—we’ll leave that up to the crystal ball holders. Instead, we will share our thoughts on how investors can position their fixed income allocations for a rising rate environment, which seems inevitable.

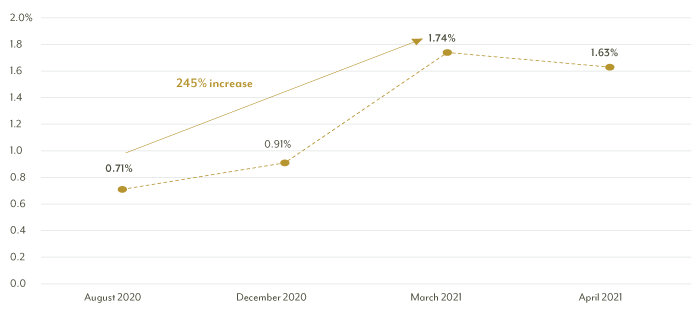

First, a quick review of the significant rate movement we have witnessed since August 2020 in the Bloomberg Barclays U.S. Aggregate Index. The yield move (Exhibit 1) has been historic for several reasons, including:

- Japanese and Korean investors selling long-dated U.S. Treasuries

- Less than enthusiastic auctions in February (specifically the 7-year Treasury auction)

- Duration hedging to offset mortgage duration extension

- The expiration of the supplemental leverage ratio (SLR)

Exhibit 1: Moves in 10-Year Treasury Yields

Source: Bloomberg.

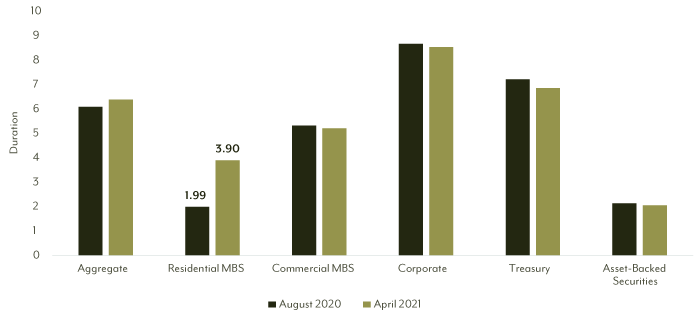

Understanding the impact of this rate movement on the index’s duration and underlying sectors is critical. Most sectors’ duration moved slightly lower over the past eight months, but the interest rate sensitive residential mortgage-backed securities (RMBS) sector has more than doubled since last August (Exhibit 2), pushing the overall index duration higher—from 6.09 years to 6.39 years at the end of April.

Exhibit 2: Changes in Duration

Source: Bloomberg.

Why is this important? The significant rate move in Q1 provides a perfect example of the impact duration has on fixed income investments—the longer the duration of an asset class, the more significant the impact of interest rate movements on performance for a given period. Exhibit 3 illustrates the different impacts of this historic rate movement on longer duration asset classes and shorter duration asset classes.

Exhibit 3: Duration Moves and Returns

| |

Duration 12/31/20 |

Q1 Return (%) |

| Aggregate |

6.22 |

-3.37 |

| Corporate |

8.84 |

-4.65 |

| Treasury |

7.21 |

-4.25 |

| Commercial MBS |

5.31 |

-2.32 |

| Residential MBS |

2.34 |

-1.10 |

| Asset-Backed Securities |

2.10 |

-0.16 |

Source: Bloomberg.

Definitions

Convexity measures the change in duration as rates move higher or lower. For small moves in interest rates, duration provides insight as to how a bond behaves from a pricing standpoint though convexity is a better measure for large fluctuations in interest rates.

Duration is the sensitivity of fixed income securities to moves in interest rates (as rates go higher, bond prices decrease and vice versa).

To-Be-Announced or TBA Mortgage: The seller of the mortgage-backed security agrees on a sale price without specifying which individual mortgages will be delivered on the date of settlement. Basic characteristics are agreed upon, such as coupon rate and the face value of the bonds to be delivered, but not much else. This process ensures that the TBA market is the most liquid market in mortgages by combining a variety of different pools into a standard format.

Is Your Fixed Income Allocation Exposed?

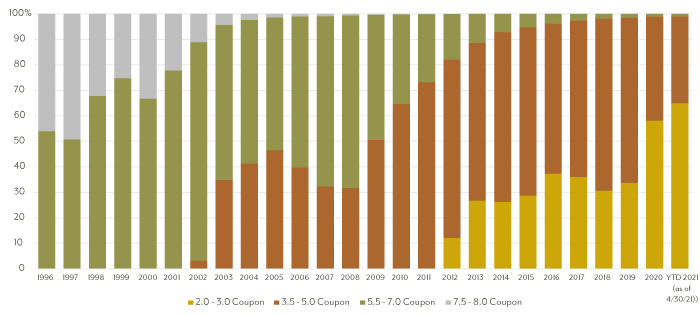

The impact of historically lower rates since the turn of the century has altered the composition of the mortgage allocation in the Bloomberg Barclays U.S. Aggregate Index. As illustrated in Exhibit 4, the past 20 years has resulted in a mortgage allocation much more heavily weighted to historically low coupons. Investors, index funds and managers who rely on plain vanilla mortgages are now more exposed to mortgages that are at risk of extending even further if rates move higher.

Exhibit 4 – MBS Coupon Composition of Bloomberg Barclays U.S. Aggregate Index

Source: Bloomberg.

How to Mitigate Interest Rate Volatility

How can investors in mortgage-backed securities mitigate some of the impact from volatility in rates? One method is by utilizing mortgage-backed securities known as collateralized mortgage obligations (CMOs), which are structured differently than the plain vanilla mortgages contained in the index. From a credit quality standpoint, there is no difference between To-Be-Announced (TBA) mortgages and pass-through mortgages issued by government sponsored entities (GSEs)—Freddie Mac, Fannie Mae and Ginnie Mae—and Agency CMOs. They are all backed by GSEs. The difference comes in the structure of the CMOs, as well as in the variety of securities. With TBA and pass-through mortgages, investors receive a pro-rata share of principal and interest for the mortgages included in the pool. This cash flow process can expose investors to prepayment or extension risk as rates move lower or higher, respectively.

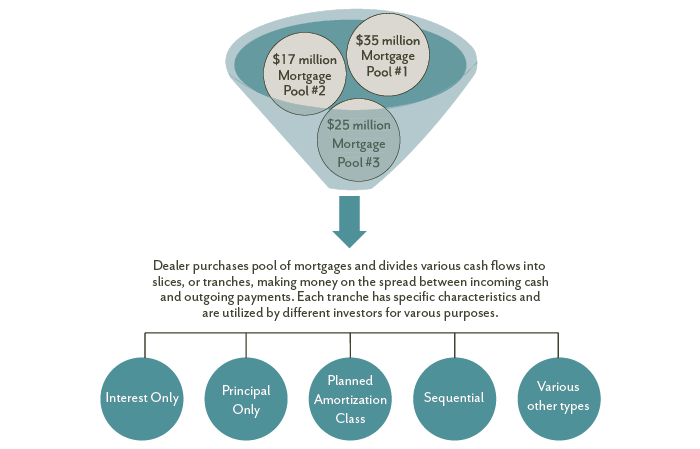

CMOs were first introduced to the market in 1983, fueled by investor desire to split out various cash flows from specified pools. Investment banks dissected mortgage pools into various cash flows, each targeted to different investor tastes for risk/return. CMOs were originally established as a sequential alternative to the pass-through market—cash flows in a mortgage pool were broken into tranches, each with an assumed weighted average life that were not paid until the bond ahead of it was paid off. As the market evolved, so did the CMO market as investment bankers created more types of CMOs to address specific client needs. The combination of mortgage pools and subsequent breakdown into CMO tranches is illustrated in Exhibit 5.

Exhibit 5

What benefit do CMOs provide to investors? The various structures available in the CMO market can help a portfolio weather periods of interest rate volatility by providing better convexity compared to pass-through or TBA mortgages. In a period like Q1 this year, when the duration of the mortgage allocation in the index extended by 1.56 years (or 67%)—exposing investors to more interest rate risk—the duration on CMOs extended but at a lower rate. Using the duration of the CMO allocation in the Diamond Hill Core Bond portfolio as a proxy, the duration of these securities extended roughly 30%—in comparison to the 67% change of those mortgages held in the index. With the potential for rising rates in the coming months and years, understanding and maintaining an allocation to the mortgage sector through CMOs could help insulate portfolios from the volatility and risk associated with potential extension (or contraction) in the mortgage market.

The Bloomberg Barclays U.S. Aggregate Index is an unmanaged index representing the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through, and asset-backed securities. Index data source: Bloomberg Index Services Limited. See diamond-hill.com/disclosures for a full copy of the disclaimer. These indices do not incur fees and expenses (which would lower the return) and are not available for direct investment.

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.

The views expressed are those of Diamond Hill Capital Management as of May 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Investing involves risk including the possible loss of principal.