Fixed Income Monthly Commentary — May 2021

Endless Summer Nights

Global vaccination rates continue to climb, and the world is (slowly) returning to some semblance of normalcy. Having been on lockdown over the past 15 months or so, it feels strange to go out to eat or to the grocery store and not have to wear a mask. But even as we venture out into the new/old world and shake off the cobwebs, what does the summer hold for the markets?

There will be good news as various economic reports are released, but will the markets react as they traditionally have? Most signs point to no.

Thanks to the Fed’s ongoing vague communication, we’re in a wait and see mode. The Fed has deftly used the word “transitory” in regards to inflation and “substantial further progress” in regards to tapering. We won’t know if inflation is truly transitory or here to stay for the long haul until late summer. The same holds true for substantial further progress, as the definition resides solely with the Fed.

Perhaps it’s time to sit back, relax and play Fed B-I-N-G-O, marking off all the transitory and substantial further progress squares on your card, as we hurry up and wait.

Federal Reserve

With regards to inflation, the term transitory refers to the fact that comparative inflation numbers are skewed. Last year, the economy was on lockdown and there was little to no pricing pressure. Now, as the economy begins to open and there is heavy demand in a supply-constrained market, we should (and have seen) an increase in prices. Oil, as measured by West Texas Intermediate Crude, is up nearly 37% since the beginning of the year while used auto prices are up 10% MoM in April and up 21% YoY, according to the U.S. Bureau of Labor Statistics’ Consumer Price Index. But even as prices ramp up, the Fed continues to beat the transitory drum, with Fed Governor Lael Brainard saying, “While these pressures may persist over the summer months, I expect them to fade and likely reverse somewhat in subsequent quarters.”

Transitory or not, inflation is here—4.2% YoY and 3.0% YoY excluding food and energy—and we will most likely see similar numbers for the next couple of months. The true determination of transitory won’t be known until late summer/early fall, and at that point it may be too late to do anything about it. Until then, we wait.

Interest Rates

After the rate volatility in Q1, some stability has been welcome over the past two months. As you may recall, the 10-year Treasury spent the first quarter climbing steadily higher, finishing at 1.74%—a level not seen since late January 2020, as strong economic reports and some technical functions pushed yields higher. Since the end of Q1, the bellwether rate has fluctuated from a high of 1.72% to a low of 1.54%, with an average of 1.62%. In the second half of May, the 10-year Treasury yield has stayed comfortably in a 11 basis points range between 1.67% and 1.56%.

Even as strong economic reports continue to come in, we remain in a holding pattern—waiting for more insightful information and waiting for a Federal Reserve that continues to push off any type of action.

Labor market

Expectations for a summer labor recovery are strong, despite a historic miss by prognosticators in April (one million new jobs estimated compared to 266,000 actual jobs). Why was there such a disconnect between economists’ expectations and the real world? Some argue it is the ongoing extended unemployment benefits, while others contend it is the difficulty brought about by a lack of childcare options for working parents. Most likely it is a combination of the two, and the coming months will help clear the air as the economy continues to open up without mask mandates.

The extended unemployment benefit of an additional $300 per week will officially end on September 6, but 25 states are looking to end those benefits early to get people back to work. The earliest end will occur in Alaska, Iowa, Mississippi and Missouri on June 12, with the rest ending between June 12 and July 19. Even the U.S. Chamber of Commerce has called for an end to the weekly unemployment bonus.

Does continued slow growth in the labor market equate to substantial further progress or do we need to see a hotter labor market? No one but Jerome Powell and the Federal Reserve know exactly, but the phrase serves its purpose—buying the Fed time to digest incoming economic data and allowing for flexibility in how it applies the idea of “thinking about thinking about tapering” the monthly purchase program.

Air Travel

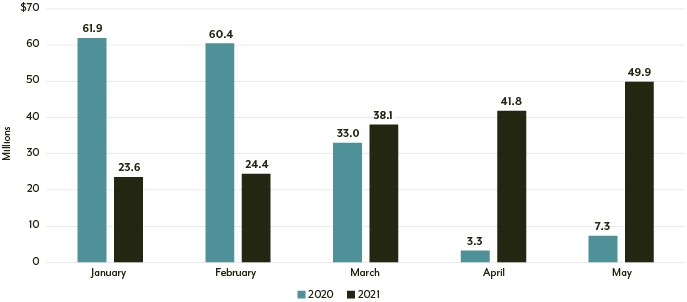

As we wait on incoming economic data, the travel industry is already out of the starting gate. Using TSA data, May traffic showed a YoY increase of nearly 680% and is only 33% less than 2019 (Exhibit 1). Considering business travel makes up roughly 30% of all air travel spend and has been nearly non-existent since the pandemic began, May numbers are impressive. Air travel has continued to ramp up each month since January, as passengers moving through TSA checkpoints has climbed more than 110% from 23.6 million to 49.9 million, with the largest jump occurring in March as families embarked once more on spring break. While the market waits to see where the opening economy will take us, consumers are hitting the road and putting their money to work after more than a year on lockdown.

Exhibit 1—The Return of Air Travel, TSA Cleared Passengers

Source: Transportation Security Administration.

The Consumer

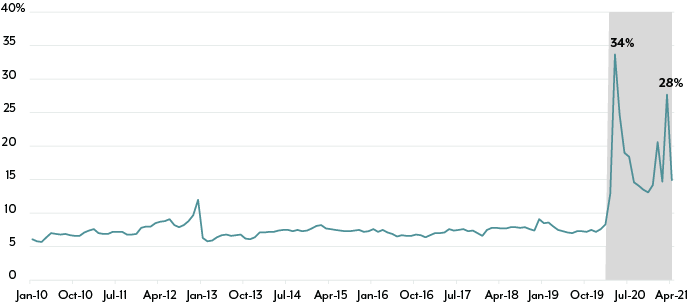

Consumer confidence, as measured by the Conference Board Consumer Confidence Survey®, has risen from 89.3 in January to 117.2 in May. Despite a slight drop from April to May, the consumer is confident and flush with cash, for the most part. According to the St. Louis Federal Reserve, the personal savings rate has averaged over 18% since the beginning of the pandemic (Exhibit 2), more than twice the historic average in a series that began in 1959.

So, we have a consumer with an accumulation of wealth from stimulus checks and lower expenses over the past 15 months due to the lockdown, combined with a rosier expectation for the future as vaccination rates climb. Could this summer become the new Roaring Twenties or will this euphoria be short-lived after we burn through the excess and return to normalcy?

Exhibit 2 – Personal Savings Rate

Source: Federal Reserve.

Long Hot Summer

With everything in place for an unprecedented summer of growth and expansion, it appears as though the Federal Reserve is going to let things run hot based on the idea that the increase in prices is transitory and the definition of substantial further progress is known only to them. So, while we’re getting back out into the world, spending pent up cash and reuniting with loved ones, the markets will wait. Wait for clarity on inflation. Wait to determine where the labor market is headed. And wait for the Federal Reserve to take action in the coming months and years.

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.