Value Investing in a World of Meme Stocks and #YOLO

Meme stocks, such as GameStop, Workhorse Group, AMC Entertainment and BlackBerry (to name a few), have received a lot of attention this year. Meme stocks, for those who might not be acquainted with this recent social media phenomenon, are those that experience hyper price volatility driven by mentions on social media platforms such as Reddit (WallStreetBets) and TikTok. Younger generations have turned to these social media platforms for investment “advice” and the fear of missing out (FOMO) has created a volatile trading environment for certain stocks.

As long-term, intrinsic value investors, this type of hype and mania simply reinforces our belief in the value of a long-term ownership mindset. Because our reasons for investing in each stock are based on fundamental analysis—and we make initial investments with the goal of owning a stock for at least 3-5 years—we have the clarity and foresight to manage and potentially benefit from short-term market volatility.

Enterprise communications software company BlackBerry, whose stock we invested in December 2020, is a great example of how our valuation discipline can help us when market behavior is atypical. We have followed BlackBerry for several years as it has transformed itself from a mobile handset provider to a software company focused on its original core strength—cybersecurity and connectivity. This core capability is what attracted us to the business in the first place—there are many practical use cases outside of mobile phones giving BlackBerry a much broader addressable market that is likely more lucrative than the legacy handset business. When we made our initial investment, we believed the market was not giving enough credit to the transformation at Blackberry and was undervaluing its intellectual property assets.

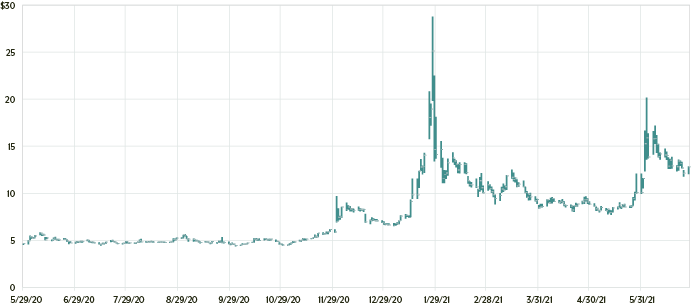

In the second half of January 2021, BlackBerry’s stock rose sharply (Exhibit 1). This was the result of recommendations from Reddit’s WallStreetBets that propelled the stock to an intraday high of $28.77 on January 27—over three times where the stock traded just two weeks prior. Because we had a clear understanding of the intrinsic value of the business and what an upside “blue sky” valuation might look like, we were able to take advantage of the market volatility when the stock price went well above our best-case estimates and trimmed our position.

Exhibit 1 – BlackBerry Limited (Ticker: BB) – High, Low, Close

Source: FactSet.

Fast-forward a few months to April when we added to our position because shares were again trading at a discount to our base estimate of intrinsic value. In late May and the first week of June, we saw another social media fueled price rally, which again prompted us to sell at attractive prices. Today, the stock is trading closer to what it was three months ago. We continue to like the business, but we remain sensitive to the market price relative to the discount to our estimate of intrinsic value.

As long-term investors, our goal is to own shares of BlackBerry for an extended period of time given the immense upside potential in the company’s autonomous vehicle segment called QNX (learn more in our recent podcast The Evolution of BlackBerry). While it is difficult to put a price tag on what the standard operating system (OS) in a vehicle could potentially be worth over time, our current fundamental assumptions for QNX could still be too low if the company is successful in building out its current vision.

As always, we use our estimate of intrinsic value as our guiding principle to help us manage all types of short-term volatility, including this latest Meme phenomenon.

As of May 30, 2021, Diamond Hill owned shares of BlackBerry Ltd.

The views expressed are those of Diamond Hill as of July 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Investing involves risk, including the possible loss of principal.