To Hedge or Not to Hedge

U.S. investors in non-U.S. stocks have a choice when considering the impact of foreign exchange (FX) on returns—to hedge or not to hedge currency risk. As long-term, intrinsic value investors, we carefully evaluate the impact of currency when estimating the intrinsic values of our holdings in the International strategy. However, we choose not to hedge currencies because the cost does not seem to justify the benefits for investors with long time horizons.

Currencies can impact stocks in multiple ways. There is the operational impact from generating profits and having cost structures in multiple jurisdictions. Reconciling financial statements from foreign operations or subsidiaries has a translation effect (a change in value resulting from exchange rates). But when investors consider hedging, most often, they intend to address the impact of foreign exchange on their local return.

A quick refresh: If a U.S. investor holds a U.K. stock that gains 12% during a time pound sterling strengthens 10% against the dollar, the U.S. dollar return would be 23%.1 But if that same stock gains 12% when pound sterling weakens 10%, the U.S. dollar return would be just 1%.

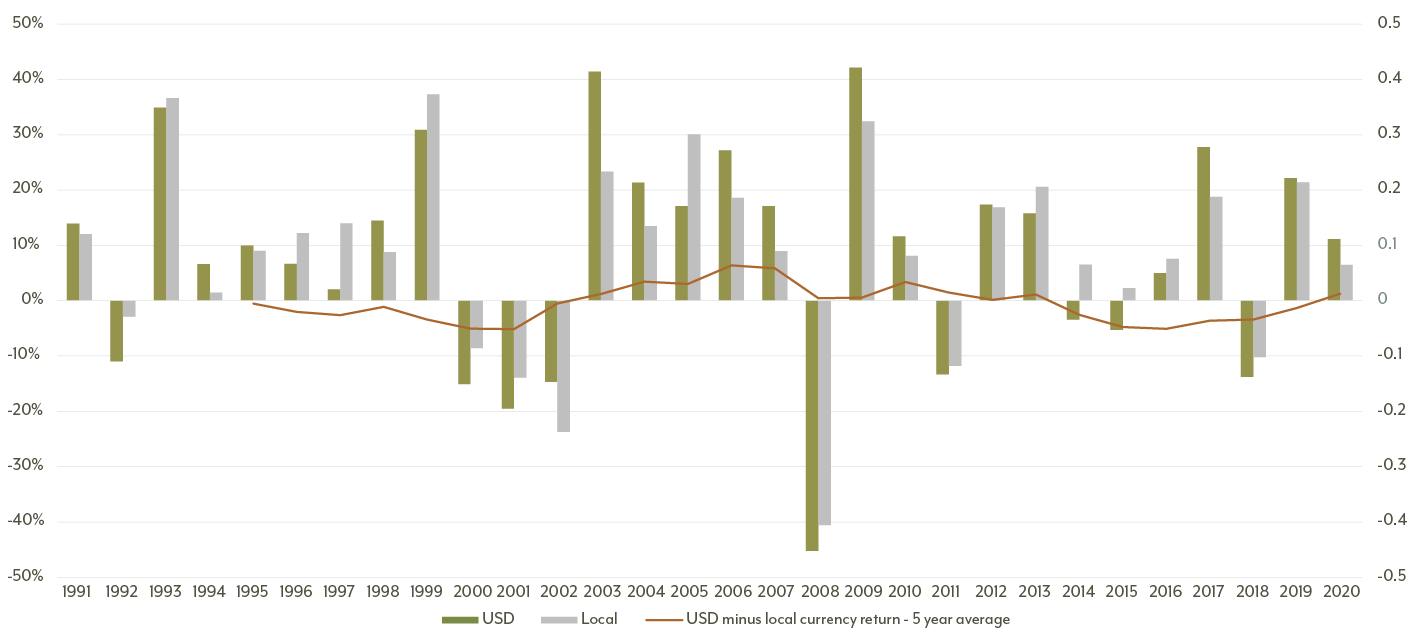

Over shorter periods, currencies can be volatile and have a real impact on portfolio returns. The bars on Exhibit 1 show the returns of the MSCI ACWI ex-USA Index in both USD and local currencies. Strategies that hedge FX risk aim to mitigate the impact of those short-term swings. However, hedging isn’t cost-free. Often, the currencies that pose the greatest potential risk (typically emerging markets currencies)—whether because of liquidity constraints, political instability or a less transparent monetary authority—are the most costly to hedge. There can also be tax implications from hedging activity, which can add additional costs.

Exhibit 1: Calendar Year Returns for Non-U.S. Stocks – Local vs. USD

Source: FactSet. MSCI ACWI ex-USA Index in both USD and local currencies.

Further, perfectly hedging all FX is a near-impossible task. One cannot calculate the currency exposure for a company without fully understanding the extent of its treasury operations–what if any hedging the company has done, the mismatch between revenues and expenses and how they change over time, and the mismatch between debt and profits and how they change over time. While companies usually provide some level of disclosure, treasury operations are so complex and depend on multiple dynamic factors (e.g., how commodity price moves interact with currency moves) that even the treasurer can only provide rough estimates on the true currency exposures of a company.

The cost to hedge could be justified if hedging adds value over time. However, we know that over longer periods, FX’s impact on stock returns tends to net out. Looking at Exhibit 1 again, the line shows the rolling 5-year annualized difference between USD vs local returns. Sometimes a bit negative, sometimes a bit positive, but overall fairly minimal. In fact, over the last 30 years, the annualized USD return of the MSCI ACWI ex-USA Index was 7%–the same annualized return of the index in local currency.

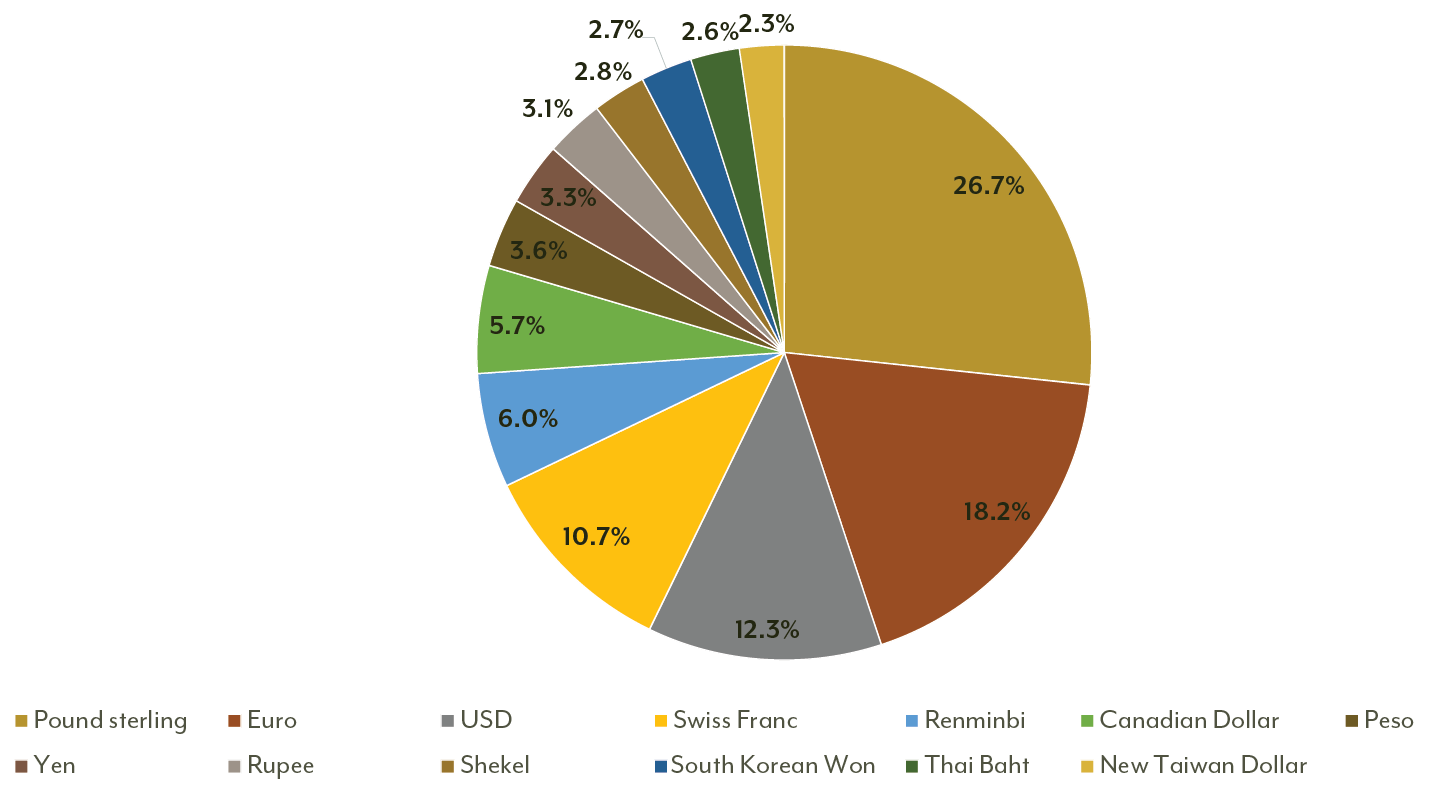

For long-term oriented investors, hedging costs are difficult to justify. Further, investors lose out on additional diversification benefits from exposure to non-U.S. currencies. Exhibit 2 shows the International strategy’s currency exposure as of February 28, 2021 based on the home currency of the underlying companies. The economic impact would, or course, look different. For our investors, we think our time is better spent on identifying great businesses rather than trying to side-step the nearer term impact of FX.

Exhibit 2: Additional Diversification Through Currency Exposure

Choosing not to hedge FX at the portfolio level doesn’t mean we ignore the impact of currency. How currencies may impact the strength of a balance sheet or could alter a company’s competitive position, cash flow generation potential or cost structures–among other factors–can often impact our long-term estimate of intrinsic value. For example, all else equal, a manufacturer with primarily non-domestic customers located where there is structural, long-term downward pressure on the home currency could have a sustainable, low-cost advantage over foreign competitors–particularly if that company is also sourcing materials domestically. But all else is rarely equal, and the impact of FX is most often one of myriad factors impacting the long-term trajectory of a quality company’s cash generation potential, which favors our approach to deep, fundamental research.

1 Return of a foreign stock is calculated as 1 + the stock return times 1 + the currency return, minus 1. Or, you can get close by adding the two returns together.

The views expressed are those of the portfolio manager as of March 2021, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

The MSCI ACWI ex-USA Index measures the performance of large and mid-cap companies in 22 of 23 developed markets (excluding the U.S.) and 29 emerging market countries.