The Case for International Investing

We are pleased to announce the launch of Diamond Hill’s International strategy. The strategy’s flexible mandate provides us with the opportunity to apply our investment philosophy and process to the large and expanding opportunity set in international markets. Our research team has over a decade of experience in evaluating international businesses, and we believe our style of investing is well-suited to these markets, positioning us well for competitive returns over full market cycles. Our enthusiasm for international investing stems from three core ideas:

- The long-term opportunity in international equities

- Hunt in a broader and growing opportunity set

- International markets favor our approach

The Long-Term Opportunity in International Equities

Most investors have a home country bias to their portfolios. In the U.S., around 70% of equities held in portfolios are U.S. companies, which is higher than both the share of U.S. market cap globally (54% of MSCI ACWI Index) and the number of U.S. companies listed globally (less than 13% of listed global companies).

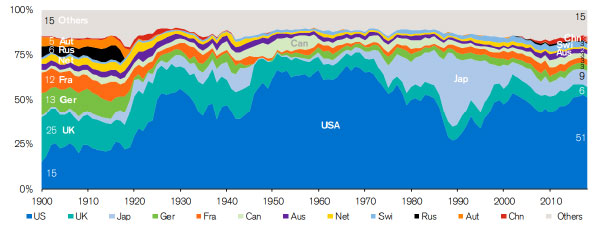

Given this bias, we believe long-term investors will find the chart below insightful. Curated by Dimson, Marsh and Staunton in their annual investment returns yearbook, it illustrates the historical shifting fortunes of equity investors by country. As we can see, it is hard to overlook that over long periods of time, geographic concentration can have a significant impact on your wealth. For example, the last century has been great for U.S. investors, while investors concentrated in Russia or Germany at the start of the 20th century faced almost certain ruin. What is also striking is the degree of variability in relative weights throughout this time, even for the “winning” U.S.-concentrated portfolio.

THE EVOLUTION OF EQUITY MARKETS OVER TIME FROM END-1899 TO END-2017

Source: Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and subsequent research.

While trivial to construct a narrative that fits this graph after the fact, it is difficult to predict these moves before they happen. For a passive investor, the prudent strategy would be to diversify away from their home country bias. The active, long-term investor, however, can do more than just geographic diversification. We believe the best approach would be to invest in a patient and flexible international strategy that can take advantage of business activity and valuation anomalies, no matter where they occur in the world. Additionally, we believe a strategy that has high equity exposure to international stocks would be preferable, rather than one biased to the U.S. market.

Investors who are truly long term and focused on preserving capital across generations are well aware of this approach. For example, the Yale endowment has reduced its exposure to U.S. securities from over 65% 30 years ago to less than 10% today, while increasing exposure to alternative asset classes, including international equities.

Hunt in a Broader and Growing Opportunity Set

As fundamental, intrinsic-value investors, idea generation is the lifeblood of our portfolios. So it is not surprising that we would prefer to hunt for ideas in the broadest and deepest opportunity set available, and that is what international markets give us – a much larger hunting ground for investment ideas. Today, the number of U.S.-listed companies is dwarfed by international listings, and this difference continues to grow as capital markets outside the U.S. become more robust over time.

As U.S. consumers, we made the switch long ago to a global marketplace. Whether it is Johnnie Walker scotch or Dove soap, we don’t know – and don’t care – if the brands we love are owned by a company listed in the U.S. To us, it seems logical to apply this same thinking to investing. When we see a great business listed outside the U.S. (in the case of the examples above, Diageo PLC and Unilever N.V., respectively), we see every reason to include them in our opportunity set, as long as they fit our criteria of attractive investments.

Over long periods, our preference is to own businesses that generate good returns on our invested capital, have strong growth prospects, and are available at attractive prices. There are many such opportunities available in international markets and over time we believe there will be even more.

International Markets Favor Our Approach

We believe our approach to investing is particularly suited to international markets. Previously, we have discussed how Diamond Hill’s domestic and international strategies share the same investment philosophy and process, one that is guided by fundamental analysis, investing with a margin of safety, and bottom-up portfolio construction (read piece here). This approach is focused on the long term and is not swayed by market noise, and we believe international markets are a great arena in which to practice such disciplined investing.

Over time, individual countries tend to go in and out of favor with investors. Therefore, even a great business can sometimes be available at a bargain price because its home market happens to be out of favor. Take the example of Brazil and our investment in the Brazilian firm B3 S.A. B3 operates the Brazilian regional exchange, a high-quality business with a near monopoly in its market. Having followed the company for years, we have a well-informed, positive view on both its business and management. As a result, during 2015 and 2016, when pessimism about Brazil caused B3 to trade well below our estimate of its intrinsic value, we were able to take advantage of this mispricing and purchase shares in an incredible business at an attractive price.

This example illustrates two advantages we possess – our deep knowledge of international businesses and the temperament to invest, and stay invested, during temporary headwinds. Over the last decade, our research team has built a vast knowledge base on a wide range of businesses globally, which gives us a strong sense of the underlying value of a business, even in the face of disconcerting headlines. Historically, our strategies have stayed invested for the long term, as long as we believed that a security offered a sufficient margin of safety and a high probability of attractive returns.

Within our International strategy, we have access to most international markets and can invest across the market cap spectrum. As a result, we can invest almost anywhere we find value, which is truly an exciting and compelling proposition.

Originally published on July 8, 2019.

As of June 30, 2019, Diamond Hill owned shares of Diageo PLC and Unilever.

The views expressed are those of the portfolio managers as of July 2019, are subject to change, and may differ from the views of other research analysts, portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice.