Fixed Income Monthly Commentary – August 2020

We are now almost five months past the steep market volatility in mid to late-March as COVID-19 brought global economies to their knees. April’s unemployment rate surging to a historic 14.7% fueled concerns about consumers’ ability to service debt on an ongoing basis. As we discussed in our May commentary, consumers came into this crisis in significantly better financial positions than the 2008-2009 financial crisis. At the end of March 2020, consumers were the least leveraged they had ever been, with a debt service ratio (DSR1) of 9.67%, the lowest level since 1980 and well below the 11.18% historic average. But would a stronger consumer balance sheet be enough to stave off record default levels in areas of the asset-backed securities (ABS) market, such as consumer unsecured, small business and student loans?

Unlike the corporate bond market where investors typically only receive official corporate performance updates quarterly, ABS investors, including Diamond Hill, can get monthly securitized market updates through remittance reports. These regular updates from the master servicer provide performance details of the underlying collateral which back the securities within the securitization trust, giving investors the opportunity to analyze how the underlying bonds are performing. Equally important to analyzing these securities is speaking with various issuers, who can provide in-depth and anecdotal information on their specific securities.

dv01 is a firm that provides end-to-end data management, reporting and analytics for loan-level consumer lending data. dv01’s reports provide unparalleled access and transparency to more than 530 securitizations totaling over $104 billion across consumer unsecured, mortgage, small business and student loans.

In this report, we’ll look at two different areas of performance of the consumer ABS market:

- Modifications – Changes to the original loan terms through a temporary pause in loan repayments, which can vary based on both the borrower and issuer. The borrower must request a modification from the issuer, as modifications are not offered automatically.

- Delinquencies – Loans where a borrower is past due on their loan payment and is not in active modification.

Modifications

The loan modification process is not new. Loan modifications come in many different forms, ranging from interest rate reductions, repayment extensions, loan type modification, or a combination of the three. Significant waves of modifications are generally regionally based due to natural disasters, with the best recent example being Hurricane Harvey and its impact on Southeast Texas. In these cases, most modifications are extensions, which do not change the end amount paid by the borrower. These payment pauses provide consumers short-term relief while ensuring they are obligated to pay off their loan in full at a later date.

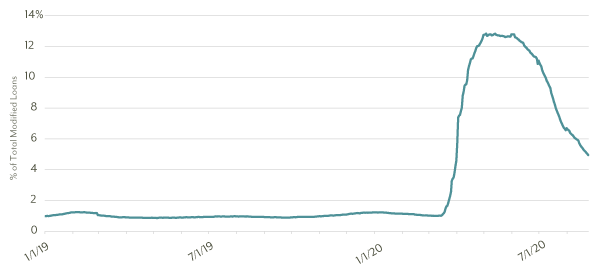

FIGURE 1: TOTAL % MODIFICATION, HISTORICAL PERIOD, ALL COMBINED

Source: dv01, August 2020.

As shown in Figure 1, modification levels were fairly steady over the past two years leading up to March 2020. As the economy began to lock down and businesses started reducing staff, modification requests and approvals ramped up significantly, nearing 15% in late March and early April. As the U.S. settled into working from home and saw a historic increase in federal unemployment benefits even as unemployment began to decline, modifications began falling and have steadily dropped to roughly 5%.

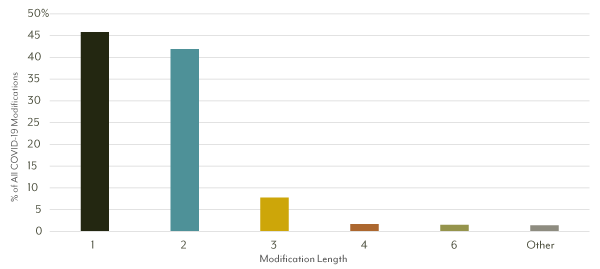

As illustrated in Figure 2, modifications due to COVID-19 are shorter in nature, with nearly 90% of the modifications requested covering one to two months.

FIGURE 2: WEIGHTS OF COVID-19 MOD LOANS BY MODIFICATION LENGTH

Source: dv01, August 2020.

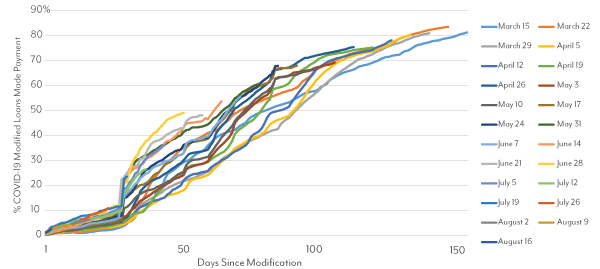

Repayments on modified loans continues to show consumer strength, with 70% of all COVID-19 modified loans resuming payments. Figure 3 breaks down the rate at which loans are being paid back, based on the week in which modifications were requested. For borrowers that requested one-month modifications, the repayment rate is quickly approaching 80%.

FIGURE 3: % COVID-19 MOD LOANS MADE PAYMENT BY MODIFICATION AGE, DAYS SINCE MODIFICATION

Source: dv01, August 2020.

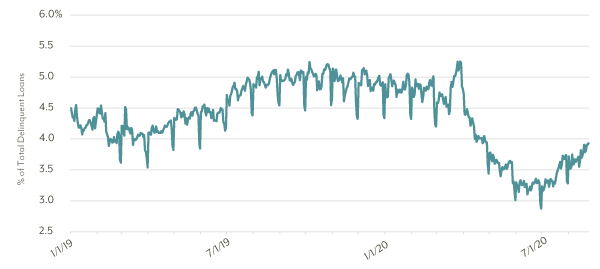

Delinquencies

While delinquencies increased roughly 25 bps to 3.5% in August, that level is still well below historical averages. Figure 4 shows the delinquency level over the past two years, with the peak coming in March and April 2020. While the drastic reduction in delinquency levels could be attributed to the unemployment stimulus issued through the CARES Act, the minimal rebound in delinquency levels over the past two months is consistent with a trajectory returning to historic levels. Since the beginning of August, new delinquency rates remain below historic levels and consistent with July’s level. We’ll have to wait and see how the elimination of unemployment stimulus checks will impact delinquencies over time, but the initial outlook is positive and reflects consumer strength coming into the crisis.

FIGURE 4: TOTAL % DELINQUENT, HISTORICAL PERIOD, ALL COMBINED

Source: dv01, August 2020.

Where Do We Stand Today?

The combination of strong consumer health coming into the pandemic and a historic level of economic support provided through the CARES Act has delivered an unprecedented recovery in the consumer unsecured ABS market. While there were concerns that delinquencies and modifications could rise as the federal stimulus ended in early August, initial data indicates payments continue in the consumer unsecured sector. Impairments, which include both delinquencies and modifications, have recovered 70% of their pandemic-related increases and remain below historic levels for the fourth straight month. Even as the stimulus package ended, repayment rates on modifications continued to increase.

As investors, we’ve maintained our investment philosophy throughout the market volatility, focused on analyzing the credit risk and structure of securitized assets. Despite periods of uncertainty and price volatility, the underwriting of most issuers has held up, and the further underwriting conducted by our team has done so as well. No one can predict the future or the progression of the pandemic and its impact on the global economy, but preliminary data for the securitized market post-Fed stimulus expiration provides some comfort for investors.

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.

1The debt service ratio is the ratio of total required household debt payments to total disposable income and is made up of two parts, mortgage DSR and consumer DSR.