Fixed Income Monthly Commentary – May 2020

Stronger Consumers Pre-Pandemic

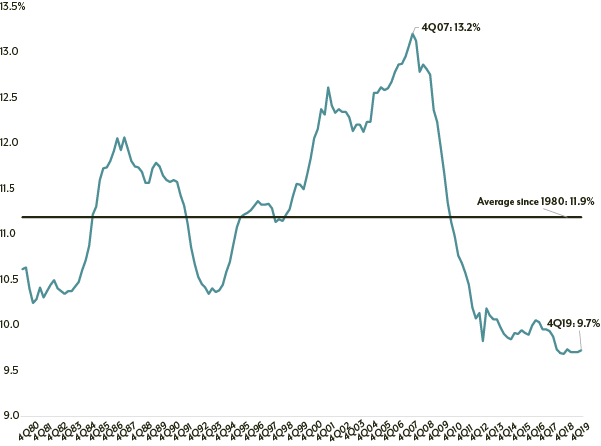

The solvency and strength of consumers remain open questions, given the historic unemployment spike since the onset of the COVID-19 pandemic. The 2008-2009 Great Financial Crisis (GFC) is often used as a measuring stick to evaluate consumers’ ability to navigate the current economic crisis—but there are key differences. Heading into the GFC, consumers were the most levered they had ever been, based on the household debt service ratio (DSR). DSR is the ratio of total required household debt payments to total disposable income and is made up of two parts, the mortgage DSR and the consumer DSR. While not an exact science as it doesn’t measure payments on every consumer loan, DSR is directionally accurate. Dating back to 1980 and measured on a quarterly basis, DSR has averaged 11.9% (Exhibit 1).

EXHIBIT 1: DEBT SERVICE RATIO SINCE 1980

Source: The Federal Reserve Board.

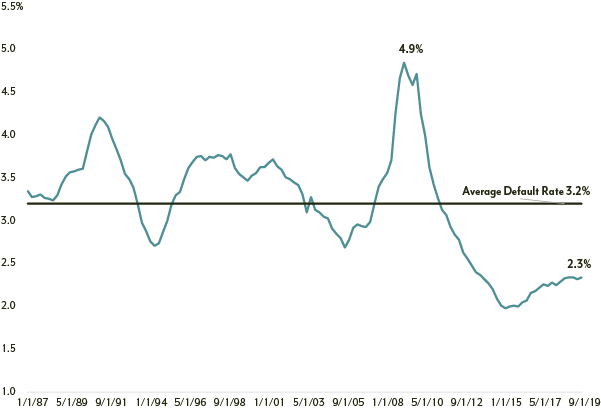

Heading into the GFC (4Q 2007), the overall DSR was 13.2%—the highest level ever and well above the long-term average. This meant that as U.S. unemployment ramped from 4.6% in June 2007 to 10.0% in October 2009, consumers were utilizing unprecedented leverage. As unemployment climbed and the housing market cratered, consumers were assailed on two sides with growing debt and decreasing or even a complete lack of income. As hardships continued to mount, consumer default rates increased and peaked in April 2009 at 4.9% (Exhibit 2).

EXHIBIT 2: CONSUMER LOAN DEFAULT RATE

Source: The Federal Reserve Bank of St. Louis.

So where did consumers stand heading into the COVID-19 pandemic? As shown in Exhibit 1, consumers used the decade since the financial crisis to de-lever, aided by historically low unemployment. They were the least levered they had ever been (DSR of 9.7%) since 1980, and the consumer loan default rate reached its lowest level (2.0%) in 2015.

None of this is to say defaults won’t increase with unemployment over 14%, and consumers won’t be unscathed. A two-month global economic shutdown likely has far-reaching ramifications. But consumers being in a historically strong position relative to overall debt coverage heading into this event should mitigate some of the damage, as should ongoing efforts from financial institutions to help consumers. The stress and strain on consumers cannot be broadly attributed to overleverage or bad actors disrupting financial markets; the pandemic impact is global, and financial institutions are working with borrowers to get through the crisis.

Weathering the Shutdown

More than two months into the global lockdown, we are getting more clarity on how consumers are faring via remittance reports, which provide consumer payment details on various loans (autos, credit cards, unsecured consumer debt). There are signs of stress, yet the news isn’t nearly as bad as it could have been. Delinquency rates are picking up as expected, but by parsing the data, we see that borrowers are accessing relief programs.

There are a variety of program options, including skipping a payment or making only partial payments. The skipped or partial payments are not forgiven—rather, they are added to the overall loan payment, usually at the end of the loan’s life. As an example, one lender reported that 11% of its borrowers enrolled in the lender’s relief program, and of those 11%, 97% made at least 30% of their scheduled payment. The willingness to work with lenders to avoid defaulting is very encouraging, as borrowers that continue making some form of payment have a much greater likelihood of paying off the debt in full. All lenders reported the number of people requesting assistance have dropped sharply since the beginning of April, so we are not expecting a big uptick next month.

Has the High Yield Opportunity Already Passed?

Tune in to the Diamond Hill podcast, Understanding Edge, to hear fixed income portfolio manager Bill Zox discuss the current state of the high yield market as well as ongoing opportunity in the space.

(disclosure)

The views expressed are those of Diamond Hill as of May 2020 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice.

The ICE BofA U.S. High Yield Index tracks the performance of the U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by Diamond Hill Capital Management, Inc. ICE Data and its third party suppliers accept no liability in connection with its use. See diamond-hill.com/disclosures for a full copy of the disclaimer.(equity).

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.