Fixed Income Monthly Commentary — February 2021

Treasury yields on the longer end of the curve continued to climb even with Jerome Powell’s testimony at the Senate Banking Committee during which he reiterated a “lower for longer” posture with regards to Fed Funds as well as the fact that the Fed isn’t “thinking about thinking about tapering.” With the short end of the curve locked in a range between 10.4 basis points (bps) and 12.1 bps throughout the month, attention turned to the longer end–and the action there did not disappoint.

The 10-year Treasury climbed steadily throughout the month, starting at 1.08% and finishing the month at 1.41%, with a high point of 1.61% on February 25, while the 30-year Treasury followed the same trajectory, rising from 1.86% to 2.15%. The February 25 peak on the 10-year Treasury was thought to be fueled by two different occurrences: a poorly received seven-year Treasury auction, which fed into convexity hedging.

Thursday’s auction delivered the longest tail for a seven-year auction on record (since 2009). The tail is the difference between the average yield (1.151% in this case) and the high yield (1.195%) for the bond being auctioned. A wide, or long, tail means there was little interest in the bond at the initial level, forcing the yield higher (price lower) to generate enough interest.

Convexity hedging occurs when the Treasury market sells off and yields climb, causing mortgages to extend and forcing investors to sell their high-quality, long-duration assets to keep overall duration under control. This can create a vicious loop: as Treasuries are sold, yields back up and mortgage duration extends, and so on and so on. As discussed in the January commentary, what could have been a mini-taper tantrum in mid-January could simply have been the precursor to a long, drawn out tantrum as the markets disregard Mr. Powell and begin to price in a rise in inflation as well as the possibility of tapering before year-end. If the job market recovers as the economy begins to re-open and pent-up demand fuels inflation as expected, how can the Fed sit on the sideline and not begin to pare back monthly purchases of $120 billion?

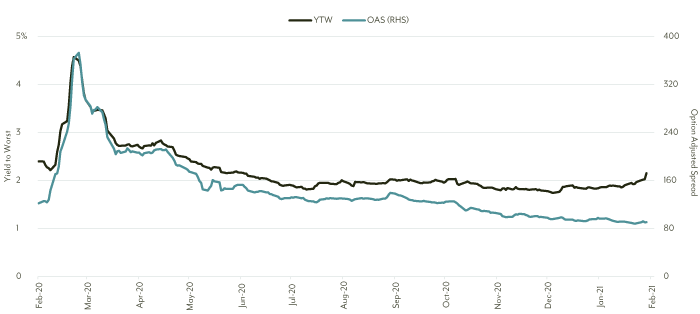

Even as the cost of debt for the U.S. government continues to climb, corporations are still in the market, taking advantage of historically cheap financing. Exhibit 1 illustrates the collapse in yields and spreads in the investment grade corporate market, fueled by investors searching for yield. The data encompasses the entire investment grade market, but what does this decrease in funding expense look like when examining a single company?

Exhibit 1

Source: Bloomberg, Bloomberg Barclays U.S. Corporate Bond Index.

Besieged by a shutdown in global travel in the early days of the pandemic, Boeing came to the market in search of funding to build cash reserves to endure the slowdown. It did so with a $3.5 billion bond issue in late April, paying a coupon of 4.875% with a five-year maturity. This “emergency” funding came on the heels of a ramp up in debt due to the grounding of the 737 MAX in March 2019, forcing the company to issue $8.4 billion in debt in April 2019 and July 2019. On the date of issuance in April 2020, the five-year Treasury was yielding 0.36%, so the spread for the deal was roughly 450 bps. Earlier this month, Boeing sought to take advantage of lower rates to repay borrowings from their 2-year term loan facility accessed in 2020 and did so with a new issue–a $5.5 billion issue maturing in 2026. The cost of the debt? 2.196%, nearly 270 bps cheaper than the deal structure just 10 months earlier. The five-year Treasury was yielding 0.44%, which means the issue came to market at a spread of roughly 175 bps, or 40% of the spread of the April 2020 issuance. Boeing benefited two-fold: once from the overall spread compression in the investment grade corporate market and second from the re-certification of the 737 MAX in November and the slow recovery of airline travel.

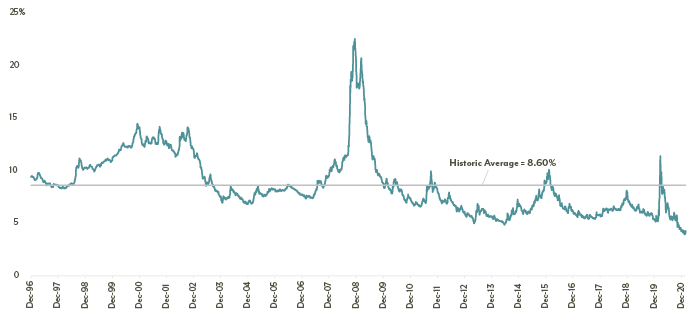

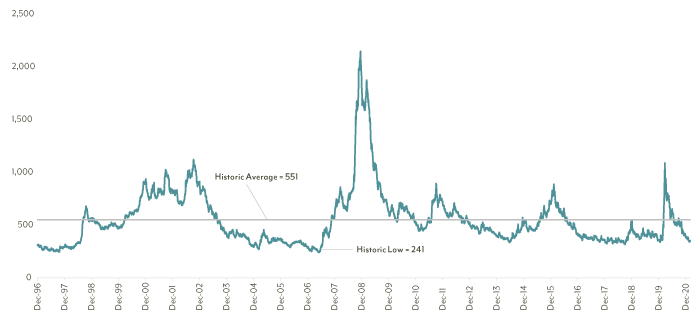

How has the consistent tightening in yields impacted the high yield market? Exhibits 2 and 3 illustrate the yield to worst (YTW) and option adjusted spread (OAS) for the ICE Bank of America High Yield Index since inception, including historic averages. Similar to what we’ve seen in the investment grade corporate space, yields and spreads have compressed significantly in the high yield market with the yield to worst at an all-time low and the OAS well below its historic average of 551.

Exhibit 2: ICE BofA U.S. High Yield Index - Yield to Worst

Exhibit 3: ICE BofA U.S. High Yield Index - Option Adjusted Spread

Car rental company Avis and its efforts to obtain financing during the crisis, as well as more recently, provides another example. Much like Boeing, Avis was hit with concerns of future business and leisure travel and was forced to obtain financing during the early months of the crisis. Avis came to the market in May 2020 with a five-year, $500 million senior secured bond offering with a coupon of 10.5% at a spread of 1,092 bps and rated BB- to provide additional funding for general corporate purposes. Fast forward to February 2021 and Avis was able to issue new debt, earmarked to pay off the May 2020 10.5% secured note. The price? The new unsecured bond maturing in 2029 came to the market at 5.375% at a spread of 432 bps and one rating notch lower at B-, cutting the company’s financing cost in half from the original issue.

The benefits of the move lower in credit spreads filtered down to the lowest tier of credit quality as CCC debt experienced a drop in financing cost as well. In another hard-hit part of the travel industry, cruise ship operator Viking Cruises issued a five-year, $675 million secured bond with a coupon of 13% in May 2020, earmarked to provide additional liquidity as travel ground to a stop. The firm came back to the market in January 2021, splitting the issuance between $350 million secured (rated B-) and $350 million unsecured (rated CCC) debt. As one would expect, the secured debt was issued with a lower coupon (5.625%) than the unsecured debt (7.000%), but both came at dramatically lower cost than the previous debt issued in May 2020.

With the dramatic move in the Treasury market at the end of the month, we’re seeing a gradual increase in bond yields, unless the Federal Reserve steps in to mitigate the upward movement. This could be achieved through yield curve control or extending monthly purchases of Treasuries further out on the curve. Or the Fed could allow the market gyrations to continue, firm in their stance that short-term rates will remain low and purchases will continue unabated. Regardless, the recent volatility in rates pushed the February issuance of investment grade corporate debt to $113.3 billion, past the February monthly record of $113.0 billion set in 2015, as issuers moved up debt sales before borrowing costs increased. Similar to its investment grade brethren, the high yield market broke the previous February issuance mark set in 2012 ($36.8 billion) with $37.6 billion in new issuance, following on the heels of a new January monthly record for issuance (close to $50 billion).

This material is for informational purposes and is prepared by Diamond Hill Capital Management. The opinions expressed are as of the date of publication and are subject to change. These opinions are not intended to be a forecast of future events, the guarantee of future results or investment advice. Reliance upon this information is in the sole discretion of the reader. Investing involves risk, including the possible loss of principal.

The Bloomberg Barclays U.S. Corporate Bond Index measures the performance of the investment grade U.S. corporate bond market. The ICE Bank of America High Yield Index tracks the performance of U.S. dollar denominated, below investment grade rated corporate debt publicly issued in the U.S. domestic market.